Disclaimer: This article is for informational purposes only and is not legal advice. For guidance tailored to your situation, consult a licensed attorney in your state..

Settling a car accident claim without hiring a lawyer might feel overwhelming at first, but thousands of people do it successfully every year. The key difference between walking away with a low settlement and walking away with a fair one often has less to do with technical legal knowledge and more to do with preparation: knowing what evidence matters, understanding how insurance companies operate, and approaching the process with patience and confidence.

What follows is a practical, straightforward guide that reflects what people learn through experience — sometimes the hard way — when handling their own claims. If you’re willing to stay organized and advocate for yourself, there is no reason you can’t negotiate a fair settlement on your own.

Read: Settlements, What Really Affects Your Payouts

Get Medical Treatment Immediately (Even If You Feel Fine)

This is the single most common mistake people make after a crash. They feel shaken but otherwise “okay,” so they skip the doctor, go home, and hope the soreness fades in a day or two. The problem is that many car-accident injuries don’t show up immediately. Whiplash, soft-tissue injuries, concussions, and back strains often take hours or even a full day to make themselves known.

Insurance companies understand this perfectly. If you wait several days to see a doctor, the adjuster might argue something like:

“If you were really injured, you would have sought treatment right away.”

To protect yourself, get evaluated as soon as possible — ideally within 24 hours at an ER or urgent care. Then schedule a follow-up appointment with your primary doctor within 48–72 hours. Keep copies of every medical record, bill, prescription, and written diagnosis. Your medical documentation becomes the backbone of your claim. Without it, insurers may claim you weren’t hurt at all or that you exaggerated your pain.

Avoid Admitting Fault or Guessing What Happened

Right after an accident, adrenaline is high, emotions run all over the place, and it’s easy to say things without thinking. A simple, polite “I’m sorry” can later be twisted into an admission of fault. Even innocent comments like “I didn’t see them” or “Maybe I was going fast” can harm your case, even if you didn’t cause the crash.

You’re not required to give detailed explanations at the scene. You don’t need to guess. And you definitely shouldn’t speculate. If someone presses you for details, it’s perfectly acceptable to say:

-

“I’m not sure.”

-

“Let’s wait for the police report.”

-

“I need to review everything first.”

Staying calm and neutral protects you from having your words misinterpreted later.

Gather Strong Evidence as Early as Possible

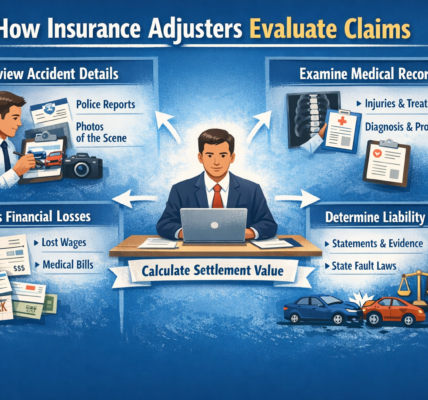

Insurance companies live and breathe documentation. If you can show them clear, organized, concrete evidence, they’re much more likely to offer a fair settlement. If you can’t, they’re more likely to delay, deny, or lowball your claim.

Right after the crash — or as soon as it’s safe — start gathering evidence. Take multiple photos of both vehicles from various angles. Capture close-ups of the damage, road conditions, skid marks, weather conditions, and any visible injuries. Photograph license plates and collect insurance details from all drivers involved.

If there are witnesses, ask if they’ll give a short statement or at least share their contact information. Get the police report number so you can request a copy later.

One tip many people overlook: take follow-up photos two or three days later. Bruising, swelling, and stiffness often worsen after the initial impact, and those photos can be incredibly important when the adjuster reviews your injuries.

Start a Daily “Pain and Recovery” Journal

Insurance companies often try to minimize injuries by calling them “minor” or suggesting they healed quickly. A pain journal helps counter that narrative. It gives you a daily record of what you’re experiencing — not vague memories a month later.

Your journal doesn’t need to be dramatic or emotional — just honest and consistent. Include things like:

-

Your pain levels each day

-

Tasks that became difficult (lifting, driving, working, bending)

-

Sleep disruptions

-

How long discomfort lasts each day

-

Any emotional frustrations or anxiety

-

Missed work or reduced hours

When you’re negotiating later, your journal becomes a timeline that shows the progression of your recovery. It’s one more piece of evidence that insurance companies can’t ignore.

Calculate Your Total Damages Before Negotiating

Never negotiate blindly. You can’t evaluate an offer — let alone counter it — unless you know the full value of what the accident cost you.

Here’s what to include:

A) Medical Expenses

Every single treatment counts: emergency visits, diagnostic tests, chiropractic sessions, follow-ups, medications, therapy, and specialist care.

B) Lost Wages

If the accident caused you to miss work, whether one day or several weeks, you’re entitled to compensation for lost income. Keep documentation from your employer or pay stubs showing your usual earnings.

C) Pain and Suffering

This is often calculated by multiplying medical bills by a number between 1.5 and 5, depending on:

-

The severity of your injuries

-

How long recovery took

-

Whether you experienced emotional distress

-

Whether your injuries caused lasting limitations

The higher the impact on your daily life, the higher the multiplier tends to be.

D) Property Damage

This includes car repairs, total-loss value, towing, rental cars, personal items damaged in the crash, and anything you had to pay out of pocket.

Once you have a solid total, you’ll be in a stronger position when the negotiation begins.

Read: Understanding Medical Expenses in a Crash Claim

Let the Insurance Company Make the First Offer — Then Reject It

Almost every first offer is a lowball. That’s not personal — it’s simply how the system works. Insurance companies assume people are stressed, overwhelmed, or desperate for quick cash, so they start low to see who will bite.

When you receive the first offer, acknowledge it politely, then take a breath. Don’t respond emotionally and don’t accept it. Wait at least 24 hours before replying. Use that time to gather your documentation and outline a clearer picture of your injuries and expenses.

When you respond, keep it calm and professional. Highlight your medical records, missed work, ongoing symptoms, and any future treatment you’ve been told to expect. Gently indicate that the offer doesn’t reflect the full extent of your damages.

Write a Strong, Organized Counteroffer

A counteroffer doesn’t have to sound like it came from a lawyer. It just needs to be clear, factual, and well-structured. Adjusters are far more likely to take you seriously when they see you’ve done your homework.

A strong counter should include:

-

A brief overview of how the accident occurred

-

A description of your injuries

-

All treatment received, with dates

-

Missed work and lost income

-

How your daily life has been affected

-

Your total calculated damages

-

A reasonable settlement amount

-

Attached evidence (photos, bills, records, etc.)

A professional tone goes further than you might think. Insurance adjusters respond better to claimants who stay calm and organized rather than confrontational.

Don’t Rush the Process

One of the biggest traps people fall into is settling too early. Insurance companies know this, which is why they often push for quick resolutions. They want you to take the small settlement before you fully understand the extent of your injuries or the cost of your recovery.

But the truth is simple:

The longer your treatment lasts and the more thoroughly everything is documented, the more your claim is worth.

Be patient. Follow your medical provider’s instructions. Don’t skip appointments. Don’t downplay symptoms during checkups. Everything gets recorded, and everything recorded can support your claim.

If You Get a Low Offer, Ask This One Question

If the next offer still feels too low, ask the adjuster:

“Can you explain how you calculated this amount?”

This question forces them to reveal what they based their number on. You’ll often learn:

-

Which medical records they ignored

-

Whether they believe your treatment was unnecessary

-

If they undervalued your lost wages

-

Whether they doubt any part of your injury

-

What evidence they consider weak or missing

This information gives you leverage for your next counteroffer. More importantly, it shows the adjuster you’re paying attention and unwilling to accept vague explanations.

Know When You Should Get Professional Help

You can handle many accident claims on your own, but there are situations where bringing in a professional is the smartest move you can make.

You should consider hiring a lawyer if:

-

Fault is being disputed

-

You suffered significant or long-lasting injuries

-

Medical bills exceed $10,000

-

The insurance company becomes uncooperative

-

You receive multiple lowball offers

-

The process is causing stress or confusion

-

You simply need support

There’s nothing wrong with seeking help when the stakes are high. Protecting your health and long-term recovery is always more important than saving a percentage of the settlement.

Final Thoughts

You absolutely can settle a car accident claim without a lawyer. Many people do it each year and walk away with a fair outcome. But success depends on staying organized, collecting solid evidence, documenting your recovery, and communicating professionally with the insurance company.

If you:

-

Seek medical treatment right away

-

Gather photos and documents

-

Maintain a clear recovery journal

-

Calculate your damages accurately

-

Stay patient and don’t rush

-

Reject lowball offers respectfully

…you can put yourself in a strong position to negotiate confidently and secure a fair settlement. You don’t need legal training to advocate for yourself — just a clear plan, good documentation, and the determination to see the process through.

If you ever feel unsure about the value of your claim or overwhelmed by the process, consulting a professional is always an option. But with the right preparation, settling your own claim is entirely achievable.

Last edited: 12/10/2025 by James Carter