Disclaimer: This article is for informational purposes only and is not legal advice. For guidance tailored to your situation, consult a licensed attorney in your state.

A car accident can happen in an instant, yet the moments that follow can feel long, stressful, and overwhelming. Even if the crash is minor, the shock of the event can make it difficult to think clearly. In these situations, staying calm and following a structured checklist is one of the most effective ways to protect your safety, your rights, and your insurance claim.

Whether you’re dealing with a small fender bender or a more serious collision, knowing exactly what steps to take can prevent costly mistakes and ensure a smooth claims process. Below is a complete guide that walks you through exactly what to do after an accident—step by step.

Stay Calm and Ensure Safety

The first and most important step is to calm your nerves. Accidents naturally trigger panic or confusion, but reacting emotionally can make the situation worse. Remaining calm helps you make rational decisions and protect everyone involved.

Here’s what to do immediately:

-

Pull over to a safe location, such as the side of the road.

-

Turn on your hazard lights to alert approaching vehicles.

-

Check yourself and passengers for injuries.

-

Avoid moving anyone who appears seriously injured unless there is immediate danger.

-

Step away from the road if the area is unsafe.

Staying composed also works in your favor later. Insurance companies, law enforcement, and even opposing parties often evaluate behavior at the scene. A calm and responsible response reflects positively on your credibility.

Call for Medical Assistance

Some injuries may be obvious—cuts, bruises, broken bones—while others may not appear until hours or days later. Whiplash, concussions, and internal trauma can develop quietly, becoming serious if untreated.

Always prioritize medical care:

-

Call an ambulance if anyone appears injured.

-

Visit a doctor or emergency room immediately—even if symptoms seem mild.

-

Keep detailed medical reports, treatment plans, and bills.

Medical documentation plays a crucial role in your claim. It demonstrates that injuries were directly caused by the accident and validates your compensation request. Getting treatment early also prevents long-term complications and supports a faster recovery.

Notify Local Authorities

One of the most important steps after an accident is filing a police report. This report becomes a central piece of evidence for both your insurance claim and any potential legal action.

When officers arrive:

-

Provide an accurate description of what happened.

-

Share your identification and vehicle information.

-

Describe any injuries or property damage.

-

Give officers the names and contact details of witnesses.

A police report includes essential details such as the date, time, location, and preliminary fault assessment. Insurance companies rely heavily on this document when evaluating claims, and failing to file one can slow down or jeopardize your payout.

Always request a copy of the report for your records.

Collect Evidence at the Scene

Evidence gathered at the scene can significantly strengthen your claim. Even small details can make a major difference.

Take photos of:

-

All vehicles involved, from multiple angles

-

Visible injuries

-

Skid marks, broken glass, and debris

-

Traffic lights, road signs, and weather conditions

-

License plates and vehicle positions

Also collect:

-

Driver’s license and insurance information from all involved drivers

-

Contact details of witnesses

-

Notes describing what happened, while it’s still fresh

The more evidence you have, the easier it is for adjusters to verify your claim. Missing or unclear details can lead to delays or reduced compensation.

Notify Your Insurance Company Promptly

Reporting the accident to your insurance company as soon as possible is essential. Most insurers require immediate notification to begin processing your claim.

Be ready to provide:

-

Your policy number

-

The date and time of the accident

-

Basic accident details

-

The police report number (if available)

Ask for a claim reference number—you will need it to track your case. Submit supporting documents, such as photos, medical bills, and repair estimates, as early as possible.

Prompt reporting demonstrates responsibility and prevents potential claim rejection due to delayed notification.

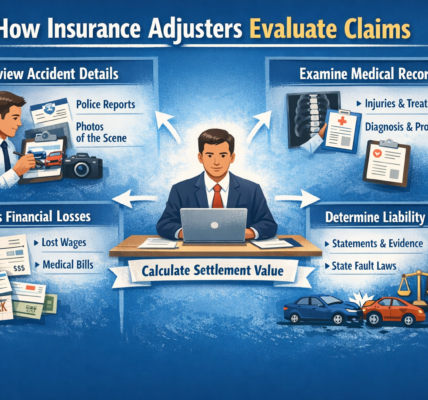

Work Closely With Your Claims Adjuster

Your insurance company will assign a claims adjuster to evaluate your case. This person reviews evidence, inspects damage, and determines the amount the insurer may pay.

To ensure a smooth process:

-

Provide requested documents quickly

-

Be honest and consistent in your statements

-

Ask questions if you don’t understand something

-

Keep records of your conversations

Developing a professional, cooperative relationship with your adjuster can speed up the review process and reduce back-and-forth communication.

Read: What To Say To An Insurance Adjustor

Keep Copies of Everything

Organizing your documents is one of the most powerful tools you have. Claims often involve dozens of items, and losing even one can delay your payout.

Keep copies of:

-

Police reports

-

Medical records and hospital bills

-

Vehicle repair estimates and receipts

-

Insurance correspondence

-

Photos, notes, and witness statements

Store your documents in a secure folder (physical or digital). When the insurance company requests information, being prepared helps avoid delays and strengthens your case.

Seek Legal Help if Needed

Not every accident requires a lawyer. However, you should consider hiring one if:

-

The insurance company disputes fault

-

Your claim is delayed or denied

-

You suffered serious injuries

-

The settlement offer seems too low

-

The other party hires an attorney

A car accident lawyer can:

-

Negotiate directly with the insurance company

-

Estimate the true value of your claim

-

Fight for compensation for medical care, lost income, and pain and suffering

-

Represent you in court if necessary

Legal support levels the playing field—especially when dealing with experienced insurance adjusters who may try to minimize payouts.

Conclusion

A car accident can disrupt your day and your peace of mind, but following a structured checklist can make the process more manageable. Each step—from seeking medical help to gathering evidence and notifying your insurer—plays a crucial role in protecting your rights and securing fair compensation.

Here’s a quick reminder of what to do:

-

Stay calm and focus on safety

-

Get medical attention right away

-

File a police report

-

Collect strong evidence at the scene

-

Report the accident to your insurance company promptly

-

Cooperate with your claims adjuster

-

Keep organized copies of all documents

-

Seek legal help when necessary

By staying organized, proactive, and informed, you can navigate the claims process confidently and increase your chances of receiving a full and timely payout. Keeping this checklist easily accessible—whether in your glove compartment or on your phone—ensures you’re prepared whenever the unexpected happens.

Read: Tips On How To Win Your Claim

Last edited: 12/11/2025 by James Carter