This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

Following a car accident, individuals often have questions about how long the insurance claim process may take. The timeframe varies depending on the facts of the accident, the type of damages involved, and the documentation required for review.

Some claims are resolved within a relatively short period, while others remain open for several months or longer. This article outlines the common stages of a car accident insurance claim and explains general factors that may influence the duration of the process.

The purpose of this overview is to describe how claims are commonly handled, not to estimate the timeline of any particular case.

General Structure of a Car Accident Claim

Although each claim differs, many follow a similar progression:

-

Accident reporting

-

Claim assignment

-

Investigation and documentation review

-

Liability assessment

-

Medical treatment period (if applicable)

-

Claim evaluation

-

Resolution and payment processing

The length of time spent in each stage varies depending on the circumstances involved.

Stage 1: Reporting the Accident

The claim process typically begins when the accident is reported to the appropriate insurance company. Reporting may occur shortly after the collision or within the timeframe required under the applicable policy.

During this stage, insurers generally collect preliminary information such as:

-

Date and location of the incident

-

Drivers and vehicles involved

-

Policy details

-

A brief description of events

Opening the claim allows the file to move forward for review.

Stage 2: Assignment of a Claims Adjuster

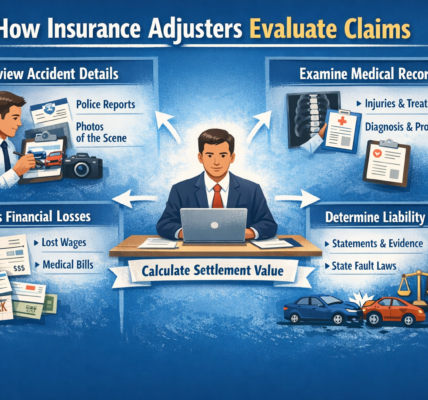

After the claim is opened, it is commonly assigned to a claims adjuster. The adjuster oversees the review process and coordinates documentation.

Responsibilities may include:

-

Confirming coverage under the policy

-

Requesting relevant records

-

Arranging vehicle inspections

-

Gathering statements

-

Reviewing available evidence

The timing of initial contact may vary depending on claim volume and internal processing procedures.

Stage 3: Investigation and Documentation Review

The investigation phase involves collecting and reviewing materials related to the accident.

Insurance companies may examine:

-

Police or accident reports

-

Photographs of vehicle damage

-

Repair estimates

-

Witness statements (if available)

-

Medical records and billing documentation (when injuries are involved)

If additional documentation is required, the claim may remain in this stage until the file is sufficiently complete for further evaluation.

Property-damage-only claims often require fewer records. Claims involving injuries typically involve additional documentation and review time.

Stage 4: Liability Assessment

Before a claim can be fully evaluated, insurers generally assess responsibility for the accident.

In at-fault insurance systems, liability helps determine which insurer is responsible for payment. In no-fault systems, certain benefits may be paid regardless of fault, though liability can still affect some aspects of the claim.

The duration of this stage may depend on:

-

Clarity of available evidence

-

Consistency of statements

-

Applicable negligence standards

-

Whether fault is disputed

If new information becomes available, liability determinations may be revisited during the process.

Stage 5: Medical Treatment Period (If Injuries Are Involved)

When injuries are part of the claim, the timeline often corresponds with medical treatment.

Insurance evaluations generally rely on documentation such as:

-

Treatment notes

-

Diagnostic reports

-

Billing statements

-

Documentation of work absence, when relevant

In many cases, evaluation of the claim does not occur until sufficient medical documentation is available. The length of treatment may therefore influence the duration of the claim.

This article does not provide medical guidance. Individuals experiencing symptoms should consult a licensed healthcare professional.

Stage 6: Claim Evaluation

After documentation has been gathered and liability reviewed, the insurer evaluates the claim based on the information available in the file.

This evaluation may consider:

-

Vehicle repair or replacement costs

-

Medical expenses

-

Documented wage loss

-

Policy limits and coverage provisions

-

Applicable state laws

If additional records are required, the evaluation stage may continue until the file is complete.

Stage 7: Resolution and Payment Processing

Once the claim is resolved, administrative steps typically occur before payment is issued. These may include:

-

Completion of required forms

-

Confirmation of claim resolution terms

-

Internal processing procedures

The time required for payment processing varies depending on insurer practices and claim complexity.

General Timeframe Ranges

While no uniform timeline applies to all claims, general patterns often include:

-

Property damage claims: commonly resolved within several weeks to a few months

-

Minor injury claims: often several months

-

Moderate or serious injury claims: may extend longer

-

Complex or disputed claims: potentially extended depending on documentation and review requirements

These ranges are general estimates and may not reflect the timing of any specific situation.

Factors That May Affect Claim Duration

Several variables commonly influence how long a claim remains open:

-

Length and type of medical treatment

-

Disputed liability

-

Multiple vehicles or parties involved

-

Delays in receiving documentation

-

Policy coverage questions

-

State-specific insurance systems

Because each claim involves different facts, timelines can vary substantially.

Why Some Claims Remain Open for Extended Periods

Insurance claims are generally reviewed through structured documentation procedures. Processing time may be affected by:

-

Time required for medical providers to supply records

-

Scheduling inspections

-

Reviewing third-party materials

-

Internal supervisory review

-

High claim volume

Extended timelines may reflect the documentation process rather than any particular outcome.

Summary

Car accident claim timelines differ based on documentation, liability considerations, medical treatment, and jurisdictional rules. Property-damage-only claims often resolve more quickly than claims involving injuries. Disputed responsibility or incomplete records may extend the process.

Understanding the general stages of review may provide context regarding how insurance claims typically progress.

Final Reminder

Insurance regulations and procedures vary by state and may change over time. Readers may wish to confirm current requirements in their jurisdiction and consult licensed professionals when appropriate.

Last reviewed for general informational accuracy: February 2026