How to File a Car Accident Claim and Get Maximum Compensation

Disclaimer: This article is for informational purposes only and is not legal advice. For guidance tailored to your situation, consult a licensed attorney in your state.

Recording a car accident claim is an essential step for every driver. Accidents can be stressful, and it’s natural to feel overwhelmed, but staying calm and taking the right steps can make the process smoother and help ensure a timely and fair settlement. Insurance companies determine payouts based on the strength of evidence, reports, and documentation. That’s why having well-organized records is crucial. Each police report, medical record, repair bill, and photograph contributes to a stronger claim.

While many claims are straightforward, some become complex, especially if the other driver disputes liability or if injuries are severe. In these situations, the help of an experienced car accident lawyer can be invaluable. This guide will walk you through the necessary steps to handle your claim effectively and secure the maximum payout.

Report the Accident Without Delay

The very first step after a car accident is to report it to the police immediately. The police report serves as the official documentation of the incident and forms the backbone of your claim. Insurance companies rely heavily on police reports when evaluating claims.

Failing to report promptly can weaken your claim or even result in denial. Make sure to include every relevant detail, such as the location, time, weather conditions, and the actions of the other driver. Take clear photographs of the accident scene, vehicle damage, skid marks, and any visible injuries. These visuals support your claim, especially if the other driver denies responsibility.

Always request a copy of the police report for your records. Having a personal copy ensures that you can reference it during the claims process and prevent discrepancies in reporting.

.

Get a Thorough Medical Examination

Even if your injuries seem minor, it is essential to visit a doctor promptly. Medical examinations serve as proof that injuries occurred and provide documentation that insurance companies require to approve payments.

Keep records of every medical visit, prescription, treatment, and therapy session. These documents show the extent of your injuries and help calculate compensation accurately. Early medical attention not only protects your health but also strengthens your claim. Delayed treatment or missing medical documentation can lead to reduced settlement amounts.

Collect Evidence and Maintain Records

Evidence is critical in building a strong case. At the accident scene, take photographs from multiple angles, capturing vehicle positions, damages, traffic signs, road conditions, and any skid marks. If possible, record license plate numbers, the make and model of vehicles involved, and the driver’s information.

Gather contact information for any witnesses present. Witness statements can provide unbiased accounts that support your claim. Additionally, keep all receipts for medical bills, vehicle repairs, towing, rental cars, and other expenses. The more thorough your documentation, the stronger your claim becomes.

Insurance adjusters carefully review these documents, and missing details can lead to delays or reduced payments. Proper evidence ensures your claim is credible and more likely to be approved promptly.

Notify Your Insurance Company Promptly

Contact your insurance company as soon as possible. Most insurance policies have specific deadlines for reporting accidents, and failing to notify them in time can result in claim denial. Provide your policy number, details of the accident, and any supporting documentation you have collected.

The insurance company will provide a claim reference number that you can use to track the progress of your case. Early notification ensures that the claims process begins quickly, which often results in faster settlements. Delays in reporting can create confusion, weaken your claim, and potentially reduce the payout.

Negotiate for a Fair Settlement

Insurance companies often start with a lower settlement offer. Do not accept the first offer without evaluating it carefully. You can strengthen your claim by presenting detailed evidence of medical expenses, repair bills, lost wages, and other costs incurred due to the accident.

Negotiation requires patience and persistence. Calmly and professionally communicate with the claims adjuster, providing supporting documents for each expense. If an offer seems unfair or too low, it is reasonable to reject it and continue negotiations. The combination of strong evidence and patient negotiation often results in a higher settlement.

Tips for Effective Negotiation:

- Attach all relevant bills and receipts to support your claim.

- Clearly explain any ongoing medical treatment or future expenses.

- Remain calm and professional during discussions.

- Understand the typical payout ranges for your type of accident to negotiate confidently.

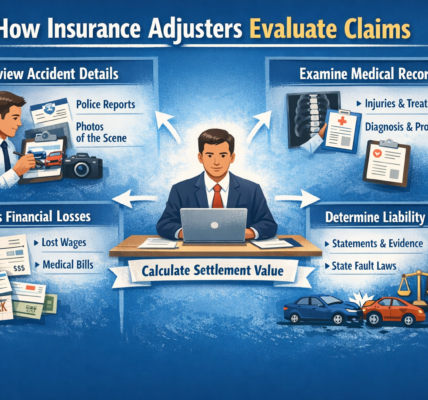

Work Closely with the Claims Adjuster

Your insurance company will assign a claims adjuster to your case. The adjuster evaluates the damages, reviews your evidence, and determines the settlement amount. Maintaining clear communication with the adjuster is essential.

Provide all required documents promptly and answer any questions accurately. Incomplete information can delay processing or reduce the payout. Working collaboratively with the adjuster ensures that your claim is assessed fairly and efficiently.

When to Consider Hiring a Lawyer

While many claims are resolved without legal assistance, hiring an experienced car accident lawyer can be extremely beneficial in complex cases. Situations where a lawyer is recommended include:

- Disputed liability by the other driver

- Severe or long-term injuries

- Complex insurance claims involving multiple parties

- Delays or unfair low settlement offers by the insurance company

A lawyer can handle communications, negotiate with insurers, and represent you in court if necessary. Their expertise can maximize your compensation and reduce stress throughout the claims process.

Conclusion

Filing a car accident claim is a structured process that requires careful attention to detail. Police reports, medical records, photographs, and receipts form the foundation of your claim. Prompt notification to your insurance company, thorough evidence collection, and effective negotiation increase the chances of a fair and timely payout.

Collaboration with the claims adjuster and, when necessary, hiring a skilled lawyer can further strengthen your case. By taking each step diligently and systematically, drivers can protect their rights and secure the maximum compensation they deserve. Remaining organized, patient, and proactive ensures a smoother claims experience and a better outcome for all parties involved.