Disclaimer: This article is for informational purposes only and is not legal advice. For guidance tailored to your situation, consult a licensed attorney in your state.

Car accident claims often feel overwhelming, especially when you’re already dealing with injuries, repair bills, and the shock of the crash itself. The moment you file a claim, you enter a world where insurance companies use trained adjusters, standardized evaluation software, and negotiation tactics designed to limit what they pay.

Most people think filing a claim is simple — but the difference between a low settlement and a fair one often comes down to how well you prepare, document, and negotiate your claim. The more proactive and organized you are, the stronger your claim becomes. This guide dives deep into the proven strategies that help accident victims secure fair compensation while avoiding common traps.

Read: What To Say To Insurance Adjustors

Start Building Your Claim at the Scene — Even If You Feel Shaken

The first few minutes after an accident can shape your entire claim. Insurance companies heavily rely on early documentation because it’s considered the most accurate.

What to capture immediately:

✔ Photos & Videos

Take clear shots of:

-

Both vehicles (all angles)

-

Skid marks

-

Traffic signs

-

Road conditions (wet, damaged, dark)

-

Debris or vehicle parts

-

License plates

-

Airbag deployment

Take both close-up and wide-angle photos. Adjusters look for consistency — good documentation eliminates “uncertainty.”

✔ Witness Information

Get:

-

Names

-

Phone numbers

-

A short summary of what they saw

Witnesses often become the deciding factor when fault is disputed.

✔ Police Report

Always request:

-

The officer’s name

-

Badge number

-

Report number

-

Information on how to request the full report

The police report becomes the “anchor document” adjusters rely on.

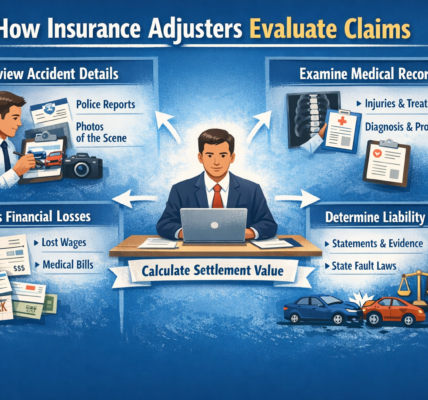

Understand Why Insurance Companies Push Back

Insurance adjusters are trained professionals whose job is to:

-

Minimize payouts

-

Question injuries

-

Challenge your evidence

-

Look for inconsistencies

-

Push low offers early

They use internal software like Colossus to estimate settlements, and the data you provide directly affects what the software calculates.

This is why every detail matters — missing information equals a lower value.

Insurers also expect that most people:

-

Don’t understand claim value

-

Want fast money

-

Are stressed

-

Accept the first offer

Being organized and patient flips the power back to you.

Read: How To Handle A Lowball Offer

Report the Accident Quickly — But Speak Carefully

You should notify your insurance company as soon as possible, ideally within 24 hours.

However, what you say matters.

When reporting the accident:

-

Stick to the facts

-

Avoid guessing

-

Don’t admit fault

-

Don’t discuss injuries until evaluated

-

Don’t speculate (“I think he was speeding”)

The adjuster will try to record your first statement because it becomes the baseline for your claim. Keep it simple and factual.

Get a Medical Evaluation Within 24–48 Hours — Even If You Feel Fine

Many accident injuries don’t appear immediately because adrenaline masks pain. Insurance companies use delayed treatment as an excuse to reduce your claim.

Hidden injuries that show up late:

-

Whiplash

-

Herniated discs

-

Shoulder sprains

-

Concussions

-

Internal bruising

-

Soft-tissue injuries

If you wait too long to get checked, the insurer may argue:

-

“This injury wasn’t caused by the accident.”

-

“The claimant exaggerated symptoms.”

A medical visit creates official proof of your injuries and establishes a timeline that supports your claim.

Build a Detailed Evidence File — Your Claim Needs More Than Photos

A strong evidence file makes negotiation easier and faster. It also reduces the insurer’s ability to question your case.

Documents you must collect:

-

Police report

-

Medical records

-

Medical bills

-

Imaging results (X-ray, MRI, CT scan)

-

Chiropractor or physical therapy notes

-

Prescriptions

-

Repair estimates

-

Towing bills

-

Rental car expenses

-

Payroll records showing lost wages

-

Emails, letters, and messages from insurers

Keep everything. Even a single missing document can cause delays or undervaluation.

Track Your Pain, Symptoms, and Daily Limitations

Insurance companies often claim your injuries are “minor” unless you provide daily documentation.

A pain journal helps prove that your symptoms are real and ongoing.

Include in your journal:

-

Pain levels (1–10)

-

Mobility problems

-

Work restrictions

-

Sleep issues

-

Emotional stress

-

Activities that now require help

-

Missed family or social activities

This creates a compelling record that strengthens your settlement amount.

Understand the Full Value of Your Claim

Insurance companies prefer to focus on the cheapest category — property damage. But medical costs and pain and suffering often make up the largest part of a fair settlement.

A complete claim includes:

A) Medical costs

ER bills, scans, medications, aftercare appointments.

B) Lost wages

Time missed from work, reduced hours, or inability to perform job duties.

C) Future medical care

Physical therapy, follow-up imaging, long-term pain management.

D) Pain and suffering

A multiplier between 1.5 and 5+ based on:

-

Severity of injuries

-

Length of treatment

-

Documented pain levels

-

Impact on daily activities

E) Property damage

Repairs, rental cars, towing fees.

Knowing your full damages before negotiations helps you counter lowball offers with confidence.

Why Hiring a Lawyer Can Dramatically Increase Your Settlement

Even though many cases can be handled without an attorney, hiring one often levels the playing field.

What a good claims lawyer provides:

-

A complete evidence strategy

-

Communication with aggressive adjusters

-

Protection from bad-faith tactics

-

Proper calculation of your claim value

-

An understanding of state-specific laws

-

Guidance on whether to accept or reject an offer

Most lawyers work on contingency (no payment unless you win), meaning there’s no financial risk to hiring one.

You may need a lawyer if:

-

Fault is disputed

-

Injuries are moderate to severe

-

The insurer is uncooperative

-

Medical bills exceed $10,000

-

The accident caused long-term injuries

-

Multiple vehicles were involved

Expect the First Offer to Be Low — It’s a Strategy

Insurance companies almost never lead with a fair offer. Low initial offers are designed to:

-

Test your patience

-

Gauge your desperation

-

See if you understand the process

Before accepting any offer:

-

Review it carefully

-

Compare it to your documented damages

-

Consider future treatment

-

Ask yourself whether it covers your pain, suffering, and daily limitations

Rejecting an early offer is normal and often necessary.

Negotiate With Confidence — Facts Beat Emotion

Negotiation is where you either win or lose thousands of dollars.

Negotiation tips:

-

Stay calm and factual

-

Reference your evidence file

-

Don’t downplay your injuries

-

Never rush — time is your leverage

-

Keep communications documented

-

Ask for explanations when offers seem low

Insurance adjusters respond to:

-

Organized claimants

-

Strong documentation

-

Clear explanations

-

Confidence backed by evidence

They do not respond well to anger or emotional arguments.

Keep Your Claim Organized From Start to Finish

A well-organized claim can settle faster and with fewer disputes.

Keep copies of:

-

Every medical bill

-

Every insurance email

-

Every repair invoice

-

Photos and videos

-

Police reports

-

Doctor recommendations

-

Notes about symptoms and daily struggles

Digital and printed versions are ideal.

The more organized your claim, the harder it is for an insurer to justify a low offer.

Conclusion: A Strong Claim Comes From Preparation, Patience, and Documentation

Winning a car accident claim isn’t luck. It’s the result of:

-

Thorough evidence

-

Prompt reporting

-

Proper medical documentation

-

Strategic negotiation

-

Patience

-

And, when needed, expert legal help

Drivers who stay calm, informed, and organized almost always secure better outcomes. By applying the steps in this guide, you protect your rights, strengthen your case, and put yourself in the best position to receive a fair and full settlement.

If your injuries are serious, or if the insurance company becomes difficult, don’t hesitate to consult a professional. The right guidance can make all the difference in both your recovery and your financial well-being.

Read: How Long Does A Settlement Take

Last edited: 12/11/2025 by James Carter