This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

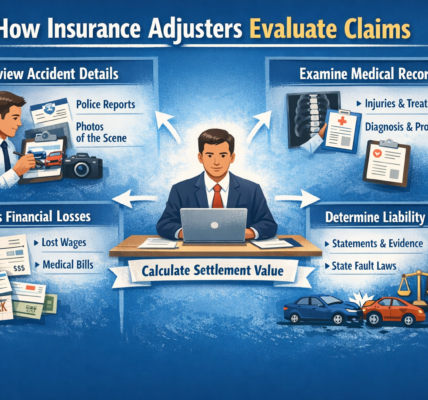

When a car accident claim is filed, insurance companies evaluate various forms of evidence to understand what occurred and to assess potential damages. The review process typically involves collecting, verifying, and comparing documentation from multiple sources.

Evidence review is not limited to a single document or statement. Instead, insurers analyze a combination of written reports, physical observations, recorded accounts, and policy information. The purpose of this review is to develop a fact-based understanding of the event and apply applicable insurance and legal standards.

This article explains the types of evidence commonly reviewed in car accident claims and how each category contributes to the overall evaluation.

Read: Insurance Adjusters & Claim Evaluation

1. Police Reports

Police reports are among the most frequently reviewed documents in car accident claims.

A report may include:

-

Date, time, and location of the collision

-

Driver and vehicle identification details

-

Road and weather conditions

-

Officer observations

-

Diagram of the accident scene

-

Citations issued, if any

While police reports can provide structured summaries and factual context, they are not always determinative of civil liability. Insurance companies generally consider them alongside other evidence.

2. Driver Statements

Insurance adjusters typically collect statements from involved drivers. These statements describe:

-

The sequence of events

-

Traffic signal conditions

-

Speed estimates

-

Lane positions

-

Observations before and after impact

When driver accounts align with physical evidence and other documentation, liability evaluation may be straightforward. When accounts differ, insurers may conduct additional review to reconcile discrepancies.

Statements are evaluated for consistency and clarity rather than taken at face value.

3. Witness Statements

Independent witnesses may provide additional context.

Witness evidence may include:

-

Written or recorded statements

-

Contact information

-

Observations regarding traffic flow or driver behavior

Insurers assess witness credibility and compare statements with other available evidence. Conflicting witness accounts may require further investigation.

4. Photographs of the Scene and Vehicles

Photographic documentation is commonly reviewed in claims involving property damage or disputed liability.

Photos may show:

-

Vehicle damage

-

Position of vehicles after impact

-

Road markings and signage

-

Skid marks

-

Debris patterns

-

Weather or visibility conditions

Visual documentation can assist insurers in understanding collision mechanics. Damage patterns may help clarify direction of force and point of impact.

5. Video Footage

In some cases, video evidence is available from:

-

Dashcams

-

Traffic cameras

-

Nearby businesses

-

Residential surveillance systems

Video footage can provide objective information about vehicle movement and timing. However, obtaining and reviewing footage may require additional coordination and technical evaluation.

When available, video evidence is typically analyzed alongside other documentation.

6. Vehicle Damage Assessments

Insurance companies review repair estimates and damage reports to evaluate property loss.

Documentation may include:

-

Itemized repair estimates

-

Body shop photographs

-

Total loss valuation reports

-

Appraisal documentation

Damage location and severity can provide insight into how the collision occurred. For example, the angle and concentration of impact may support or contradict certain accounts.

7. Medical Records (When Injuries Are Reported)

If injuries are part of the claim, medical documentation becomes a central component of evidence review.

Commonly reviewed records include:

-

Emergency room reports

-

Physician treatment notes

-

Diagnostic imaging (such as X-rays or MRIs)

-

Physical therapy documentation

-

Follow-up evaluations

Medical records are typically reviewed to understand:

-

The nature of reported injuries

-

Treatment timeline

-

Consistency of documented symptoms

-

Relationship between the accident and medical findings

Insurers evaluate documentation rather than making independent medical determinations.

8. Medical Billing Records

Billing statements often accompany medical records.

These documents may show:

-

Dates of service

-

Procedure codes

-

Itemized charges

-

Insurance payments

Billing records assist insurers in calculating financial components of injury claims.

9. Wage Verification Documents

If lost income is claimed, insurers commonly review:

-

Employer verification letters

-

Pay stubs

-

Tax documentation

-

Disability forms

These materials help confirm income and absence from work.

10. Insurance Policy Documentation

Insurance policies define coverage parameters. Insurers review:

-

Declarations pages

-

Coverage limits

-

Endorsements

-

Effective dates

-

Exclusions

Policy language determines whether certain damages are covered and to what extent.

11. Event Data Recorder (EDR) Information

Some vehicles contain electronic data recorders that capture limited pre-collision information, such as:

-

Vehicle speed

-

Brake application

-

Seatbelt usage

-

Airbag deployment

Accessing EDR data may require specialized tools and consent procedures. When relevant, this information may contribute to liability evaluation.

12. Traffic and Environmental Records

In certain cases, insurers review external data sources, including:

-

Traffic signal timing reports

-

Weather records

-

Road maintenance documentation

These records may provide contextual information regarding environmental conditions at the time of the collision.

13. Prior Claim or Damage History

Insurance companies may review prior claim records or vehicle damage history when evaluating new claims.

This review may clarify:

-

Whether damage is pre-existing

-

Whether similar injuries were previously reported

-

Whether repair work was completed before the current accident

Such review does not automatically affect the outcome of a claim but may provide additional context.

Read: What Documents Are Needed After A Car Accident

How Evidence Is Evaluated Collectively

Insurance companies generally assess evidence holistically rather than relying on a single document. Adjusters compare:

-

Physical evidence

-

Recorded statements

-

Official reports

-

Medical documentation

-

Policy language

Consistency across sources may support a clearer liability determination. Inconsistencies may prompt additional review or requests for clarification.

The evaluation process is intended to ensure that decisions align with documented facts and applicable state standards.

Why Evidence Review May Take Time

Evidence collection and verification can extend timelines due to:

-

Delayed police report availability

-

Pending medical records

-

Difficulty contacting witnesses

-

Coordination between multiple insurers

-

Technical analysis of vehicle data

While timelines vary, thorough evidence review is typically intended to support accuracy rather than delay resolution unnecessarily.

Conclusion

Car accident claims are evaluated through review of multiple categories of evidence, including police reports, driver and witness statements, photographs, repair estimates, medical records, billing documentation, and policy language. In some cases, digital data or environmental records may also be considered.

Insurance companies assess evidence collectively to form a fact-based understanding of the collision and apply relevant coverage standards. Because each claim depends on its unique documentation and jurisdictional framework, the specific evidence reviewed may vary.

For guidance tailored to individual circumstances, consultation with licensed professionals may be appropriate.