This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

Independent witnesses can provide additional perspective after a car accident. However, many collisions occur without third-party observers. In those situations, insurance companies must rely on other forms of documentation to evaluate what occurred.

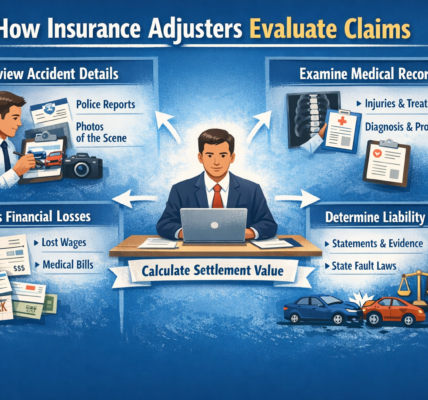

The absence of witnesses does not automatically prevent a claim from being reviewed or resolved. Instead, insurers follow a structured evidence review process using available documentation. This article explains how insurance companies typically evaluate car accident claims when no independent witnesses are present.

Read: Insurance Claims & Adjusters

The Role of Witnesses in Claims

Witnesses are considered independent sources of information. When available, their statements may help clarify:

-

The sequence of events

-

Traffic signal status

-

Vehicle positioning

-

Driver actions

However, witness accounts are only one component of a broader evaluation process. When no witnesses are available, insurers rely more heavily on other forms of evidence.

1. Reviewing Driver Statements

In the absence of witnesses, insurance adjusters typically begin by reviewing statements from the involved drivers.

These statements may include:

-

Description of events leading up to the collision

-

Speed estimates

-

Road and traffic conditions

-

Vehicle positioning

-

Actions taken before impact

When driver accounts align, liability decisions may be straightforward. When accounts conflict, additional review is often necessary.

Adjusters compare statements for internal consistency and alignment with physical evidence.

2. Evaluating Police Reports

If law enforcement responded to the accident, the police report may provide important documentation.

Reports often include:

-

Officer observations

-

Scene diagrams

-

Recorded statements from drivers

-

Citations issued

-

Environmental conditions

Although police reports may not conclusively determine civil liability, they are frequently referenced in insurance evaluations.

If no officer observed the collision directly, the report may rely primarily on driver accounts, which may limit its conclusiveness.

3. Analyzing Vehicle Damage

When there are no witnesses, physical evidence becomes particularly important.

Adjusters often review:

-

Point of impact

-

Location and severity of damage

-

Deformation patterns

-

Paint transfer

-

Airbag deployment

Damage analysis may help clarify impact direction and relative vehicle positioning. In some cases, insurers consult vehicle appraisers or accident reconstruction specialists for further evaluation.

4. Reviewing Photographs and Video

Photographs taken at the scene may provide visual context, including:

-

Vehicle positions

-

Road markings

-

Traffic signage

-

Weather conditions

If dashcam or surveillance footage exists, insurers may review it to supplement documentation.

Even without witnesses, visual documentation can contribute to a clearer understanding of the collision.

5. Considering Traffic and Roadway Conditions

Insurance companies may evaluate:

-

Intersection layout

-

Lane configurations

-

Traffic control devices

-

Visibility factors

These environmental factors may be considered when analyzing driver statements and damage patterns.

6. Applying State Liability Standards

Fault determination is guided by state negligence rules, which may include:

-

Pure comparative negligence

-

Modified comparative negligence

-

Contributory negligence

When no witnesses are present, insurers apply these legal standards to the available documentation. In comparative negligence states, liability may be apportioned between drivers based on evidence review.

7. Reviewing Consistency Across Documentation

Without witness accounts, consistency becomes especially important.

Adjusters may compare:

-

Driver statements

-

Police diagrams

-

Photographic evidence

-

Repair estimates

-

Vehicle data

If documentation aligns coherently, liability decisions may proceed. If inconsistencies arise, additional clarification may be requested.

8. Event Data Recorder (EDR) Information

Some vehicles contain electronic data recorders that capture limited pre-collision information, such as:

-

Speed

-

Brake application

-

Airbag deployment

When relevant and accessible, EDR data may provide additional factual context. Accessing and reviewing such data may require specialized analysis.

9. Internal Review and Supervisory Oversight

Claims without witnesses sometimes undergo additional supervisory review to ensure that liability decisions are supported by documentation.

Internal review may include:

-

Supervisor evaluation

-

Compliance checks

-

Documentation completeness review

This process helps ensure consistency with company standards and regulatory requirements.

10. When Evidence Is Inconclusive

In some cases, available evidence may not clearly support one version of events over another.

When documentation remains inconclusive, insurers may:

-

Assign partial fault where state law permits

-

Continue investigation

-

Seek additional documentation

The approach depends on the specific facts of the case and applicable jurisdictional standards.

Common Misconceptions

Misconception: A claim cannot proceed without witnesses.

Many claims are resolved without third-party witness testimony.

Misconception: The absence of witnesses automatically determines fault.

Liability is based on the totality of evidence rather than the presence or absence of witnesses alone.

Misconception: Police reports replace witnesses entirely.

Police reports provide context but may rely on driver statements if no independent observers are available.

Why the Review Process May Take Time

When witnesses are absent, insurers may spend additional time:

-

Comparing documentation

-

Reviewing physical evidence

-

Applying state liability standards

-

Conducting internal quality checks

The goal of extended review is generally to ensure that decisions are supported by documented facts.

Read: How Do Insurance Companies Use Photographs For Car Accidents

Conclusion

If no witnesses were present at the time of a car accident, insurance companies rely on other forms of evidence, including driver statements, police reports, vehicle damage analysis, photographs, and applicable state negligence standards. The absence of witnesses does not prevent claim evaluation, but it may require more detailed documentation review.

Each claim depends on its specific facts, available evidence, and jurisdictional framework. Because procedures vary by insurer and state law, outcomes and timelines differ between cases.

For guidance tailored to individual circumstances, consultation with licensed professionals may be appropriate.