This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

After a car accident claim is processed and closed, questions sometimes arise about whether the claim can be reopened. The answer depends on several factors, including how the claim was resolved, whether a settlement agreement was signed, the type of damages involved, and applicable state laws.

In some situations, claims remain administratively open or may be revisited under specific conditions. In other situations, closure may be final due to contractual or legal limitations.

This article provides a general overview of how insurance companies approach the concept of reopening a car accident claim.

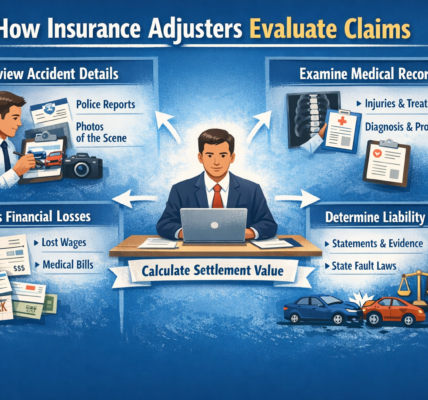

Read: Insurance & Claim Evaluations

Understanding Claim Closure

Before considering whether a claim can be reopened, it is important to understand what “closed” typically means in insurance administration.

A claim may be closed when:

-

Payment has been issued for property damage

-

A bodily injury settlement agreement has been signed

-

Documentation has been finalized

-

No further activity is pending

Claim closure generally indicates that the insurer has completed its review and processed any agreed payments. However, the type of closure matters when evaluating whether reopening is possible.

Situations Where a Claim May Remain Administratively Open

Some claims are closed for one component while another remains open.

For example:

-

Property damage may be finalized while injury treatment continues

-

Partial payments may be issued pending further documentation

-

Subrogation processes between insurers may remain active

In these cases, reopening may not be necessary because the claim file has not been fully resolved.

Reopening Property Damage Claims

In certain circumstances, additional vehicle damage may be discovered after initial repairs begin.

When this occurs, insurers may review:

-

Supplemental repair estimates

-

Photographic documentation

-

Appraisal updates

If the claim has not yet been formally finalized with a complete payment and closure notice, insurers may process supplemental documentation as part of the original claim.

However, once a total loss settlement is completed and ownership is transferred, reopening may not be available.

Reopening Injury Claims Before Settlement

If a bodily injury claim remains unsettled and medical treatment continues, the claim typically remains open.

During this period:

-

Additional medical documentation may be submitted

-

Billing records may be updated

-

Treatment timelines may evolve

Because no final release has been signed, the insurer may continue evaluating documentation.

In these cases, reopening is not required because the claim is still active.

Effect of Signed Settlement Agreements

When a bodily injury claim is resolved through a signed release agreement, reopening becomes more complex.

Settlement agreements often include language stating that:

-

The payment resolves all known and unknown claims related to the accident

-

Future claims arising from the incident are waived

Once such a release is executed and payment is issued, insurers typically treat the claim as fully resolved.

Whether reopening is possible depends on contract terms and applicable state law.

Policy-Based Limitations

Insurance policies define coverage terms and procedural requirements. Some policies include:

-

Deadlines for submitting supplemental claims

-

Requirements for documentation

-

Notice provisions

If a claim is closed due to failure to meet policy conditions, reopening may depend on whether those conditions can still be satisfied under policy language.

Statute of Limitations Considerations

State law establishes deadlines for filing legal claims related to car accidents. Even if an insurance claim is administratively closed, legal time limits may affect whether additional action is available.

These deadlines vary by jurisdiction and claim type. Once statutory deadlines pass, reopening options may be limited.

Clerical Errors or Administrative Oversight

In some cases, claims may be reopened due to administrative issues, such as:

-

Payment calculation errors

-

Incorrect policy application

-

Documentation misclassification

If an error is identified shortly after closure, insurers may review the file to determine whether correction is appropriate.

Fraud or Misrepresentation Discoveries

If new information emerges suggesting material misrepresentation, insurers may review closed claims for compliance purposes.

Conversely, if documentation was unavailable during initial review but later becomes accessible, insurers may evaluate whether reconsideration is warranted under policy terms.

These situations are fact-specific and vary widely.

Subrogation and Inter-Insurer Processes

Even when a claimant’s portion of the claim is closed, insurers may continue subrogation processes behind the scenes. Subrogation involves reimbursement between insurance carriers.

This administrative activity does not typically reopen the claimant’s settlement but may affect inter-company accounting.

Partial Reopening Versus Full Reopening

In some circumstances, insurers may review only a specific portion of a claim file rather than reopening the entire claim.

Examples include:

-

Supplemental vehicle repair documentation

-

Outstanding medical billing

-

Clerical correction of payment amounts

The scope of review depends on how the claim was originally resolved.

Why Reopening Is Often Limited

Insurance companies rely on finality in settlement agreements and policy administration. Once documentation is reviewed, payments are issued, and releases are signed, administrative closure promotes clarity and consistency.

Reopening finalized claims without defined procedural grounds could create uncertainty in contract enforcement. For this reason, reopening is typically governed by clear policy terms and legal standards.

Common Misconceptions

Misconception: A claim can always be reopened if new issues arise.

Reopening depends on policy language, settlement agreements, and state law.

Misconception: Property damage and injury claims are treated the same.

Each component may follow different procedural rules.

Misconception: Closure means no further communication is possible.

Administrative closure does not prevent inquiries, but it may limit further payments.

Read: What Happens If A Claim Is Denied

Conclusion

Whether a car accident claim can be reopened depends on how the claim was resolved, whether a settlement release was signed, applicable policy terms, and jurisdictional law. Claims that remain administratively open may continue processing without formal reopening. Fully settled claims, particularly those resolved through signed release agreements, are typically considered final under contract terms.

Because insurance policies and legal standards vary by state, reopening possibilities differ between cases. For guidance tailored to individual circumstances, consultation with licensed professionals may be appropriate.