Disclaimer: This article is for informational and educational purposes only. It does not constitute legal advice. For guidance specific to your situation, consult a licensed attorney in your state.

After a car accident, one of the first contacts many people receive is a call from an insurance adjuster. These conversations are often polite and professional in tone, and may include questions about the accident, injuries, and next steps in the claims process.

How these early conversations unfold can influence how a claim is later reviewed, including factors such as:

-

how settlement discussions develop

-

how medical bills are evaluated

-

how liability questions are assessed

-

whether additional documentation is requested

-

how long the review process may take

Many claimants are unaware that statements made early in the process can later be reviewed alongside medical records, police reports, and other documentation.

This guide explains how insurance adjuster conversations are commonly evaluated and highlights communication patterns that are often discussed in claim-handling contexts.

For additional background on insurance adjuster roles, see: Insurance Adjusters & Claim Evaluations.

This guide focuses on commonly observed insurance claim practices and communication patterns to help readers understand how adjuster conversations are typically evaluated.

What People Often Don’t Realize About Adjuster Conversations

A common assumption is that once fault appears clear, the insurance process becomes straightforward. In practice, even claims with apparent liability can involve extended internal review, documentation checks, and cost evaluations that are not visible to claimants.

Another frequent misunderstanding is that early conversations reflect an insurer’s final position. Initial discussions are often exploratory and may occur before medical treatment, wage loss, or repair costs are fully known.

What Typically Happens in Practice

Insurance adjusters often manage multiple claims at the same time and may prioritize files based on documentation completeness, timing, and procedural requirements. Claims with incomplete records or inconsistent follow-up may progress more slowly, even when underlying facts are similar.

It is also common for insurers to delay full evaluation until medical treatment stabilizes, which can result in long periods of limited communication that feel confusing to people unfamiliar with the claims process.

The Insurance Adjuster’s Role in the Claims Process

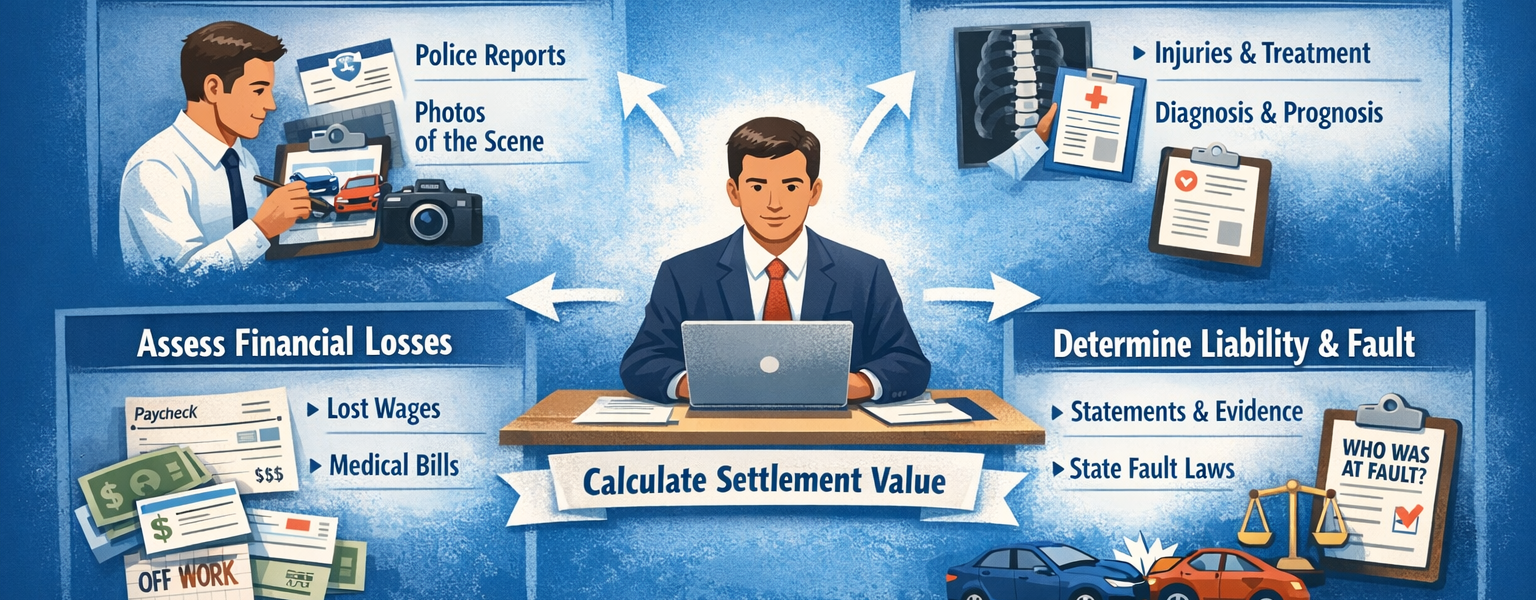

Insurance adjusters evaluate claims on behalf of insurance companies. Their responsibilities typically include:

-

gathering information about the accident

-

reviewing documentation

-

assessing liability

-

applying policy terms

-

determining how a claim may be resolved

Because adjusters operate within internal guidelines focused on efficiency and consistency, how information is communicated early in the process can affect how a claim is reviewed later.

The National Association of Insurance Commissioners (NAIC) notes that adjusters must follow fair claims-handling standards and may not pressure or mislead claimants.

Source: https://content.naic.org

Communication Tone and Documentation

Adjuster conversations are documented, including tone and phrasing. Emotional or unclear communication can sometimes complicate how statements are later interpreted during review.

Common Communication Characteristics Observed in Claims

-

polite

-

brief

-

factual

-

neutral

Many claimants find it helpful to treat adjuster conversations as professional exchanges rather than informal discussions.

Types of Information Adjusters Commonly Request

The examples below reflect communication approaches often discussed in claims contexts. They are illustrative only and not required responses.

Adjusters may listen closely for subjective language, such as statements about pain levels or recovery expectations, which can later be compared against medical records or timelines.

Basic Information Commonly Confirmed

-

name and contact information

-

policy number

-

date, time, and general location of the accident

Other information—such as medical history, employment details, or personal background—may be reviewed later through documentation rather than initial conversations.

According to the Insurance Information Institute (III), adjusters are trained to evaluate claims carefully and consistently, which is why early statements are often reviewed alongside records obtained later.

Source: https://www.iii.org

Written Communication and Documentation Timing

Some claimants prefer to provide detailed information after documentation is available. Written communication can help reduce misunderstandings and create a clear record of what was requested and provided.

It is also common for people to indicate that medical evaluation or document collection is ongoing when treatment or estimates are not yet complete.

The Centers for Disease Control and Prevention (CDC) notes that certain injuries, including concussions, may develop or worsen hours or days after a collision.

Source: https://www.cdc.gov/traumaticbraininjury

Recorded Statements and Early Requests

Recorded statements are sometimes requested early in the claims process, before treatment or documentation is complete. Statements made at this stage may later be reviewed in light of additional information that becomes available.

Consumer protection guidance from state insurance departments, such as the Texas Department of Insurance, explains how insurers must communicate with claimants and respond in good faith.

Source: https://www.tdi.texas.gov

Common Claim Review Complications

During claim evaluation, insurers may revisit statements that involve:

-

assumptions or speculation

-

early conclusions about fault

-

statements minimizing symptoms

-

broad authorizations or incomplete context

For this reason, many experienced claimants focus on providing consistent, documented information over time rather than extensive explanations in early conversations.

Why Early Conversations Occur

Insurers often make early contact because key information—such as medical outcomes, repair costs, or wage loss—has not yet been fully established. Early conversations are typically part of information gathering rather than final evaluation.

When Claimants Consider Legal Guidance

Some people choose to consult an attorney when injuries are ongoing, fault is disputed, or settlement discussions stall. Many personal injury attorneys offer consultations and work on a contingency basis, meaning fees are typically tied to recovery rather than charged upfront.

Conclusion: How Early Conversations Can Influence a Claim

Insurance adjuster conversations may feel routine, but statements made early in the process can later be reviewed alongside documentation, medical records, and timelines.

In practice, many claimants focus on factual communication, written follow-up, and allowing medical evaluation to develop before engaging in detailed discussions. Understanding how claims are commonly reviewed can help reduce confusion and set more realistic expectations during the process.

Last reviewed for informational accuracy: January 2026