This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

Most car accident insurance claims follow a predictable path: the accident is reported, documentation is gathered, liability is assessed, and damages are evaluated. However, some claims are routed for what insurers refer to as “further review,” “additional investigation,” or “escalated evaluation.”

Being notified that a claim requires further review can create uncertainty. In many cases, this designation does not imply wrongdoing or denial. Instead, it typically indicates that additional verification, documentation, or analysis is required before the insurer can finalize its determination.

This article explains common factors that may trigger a car accident claim to be sent for further review and outlines how insurers generally approach these situations.

What Does “Further Review” Typically Mean?

When a claim is flagged for further review, it usually means that the standard processing workflow has been paused pending additional evaluation. This may involve:

-

Supervisor-level review

-

Special investigation unit (SIU) review

-

Additional medical documentation analysis

-

Coverage clarification

-

Legal consultation within the insurance company

The purpose of further review is typically to confirm accuracy, verify documentation, and ensure compliance with internal guidelines and applicable regulations.

1. Disputed Liability

One of the most common triggers for additional review is uncertainty regarding fault.

Claims may be escalated when:

-

Drivers provide conflicting accounts

-

Witness statements differ

-

The police report is inconclusive

-

Traffic signal sequencing is unclear

-

Multi-vehicle collisions complicate causation

In states that apply comparative negligence standards, determining percentages of fault may require detailed reconstruction or supervisory input. Until liability is reasonably established, insurers may withhold final decisions.

Further review in these situations focuses on factual clarification rather than presuming responsibility.

2. Significant or Catastrophic Injuries

Claims involving serious injuries often undergo additional scrutiny due to their financial implications and long-term considerations.

Examples include:

-

Traumatic brain injuries

-

Spinal cord injuries

-

Multiple fractures

-

Long-term disability claims

These cases may require:

-

Independent medical evaluations

-

Specialist record review

-

Long-term care cost projections

-

Legal department consultation

Escalation in serious injury cases typically reflects complexity rather than suspicion.

3. Inconsistent Medical Documentation

Insurance companies review medical records to evaluate causation and treatment reasonableness. A claim may be routed for further review if documentation raises questions such as:

-

Gaps in treatment

-

Delayed initial care

-

Inconsistent symptom reporting

-

Conflicting diagnostic findings

-

Treatment exceeding typical duration for the reported injury

Further review allows the insurer to reconcile inconsistencies or request clarification before reaching a conclusion.

It is important to note that documentation inconsistencies do not automatically invalidate a claim; they may simply require additional explanation.

4. Coverage Questions

Policy interpretation issues frequently trigger escalation.

Examples include:

-

Lapsed policy status at time of accident

-

Disputed vehicle ownership

-

Commercial versus personal vehicle use

-

Uninsured or underinsured motorist coverage disputes

-

Policy exclusions

If coverage is unclear, insurers may involve internal legal or underwriting teams. Coverage questions must be resolved before payments are issued.

5. High Claim Value Relative to Policy Limits

When a claim approaches or exceeds policy limits, additional review may occur.

High-value claims often require:

-

Supervisor approval

-

Legal department consultation

-

Multi-party settlement coordination

This review ensures that any settlement aligns with policy terms and regulatory obligations.

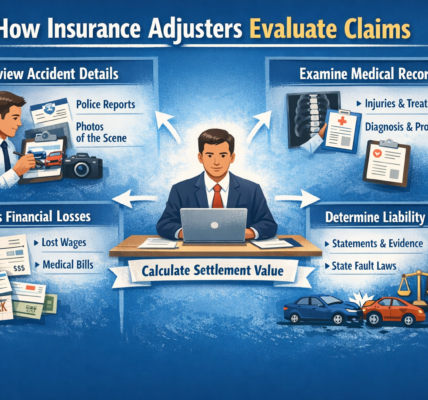

Read: Insurance Adjusters & Claims

6. Prior Claims History

Insurance companies maintain internal claim history records. A claim may receive further review if:

-

There is a recent history of multiple claims

-

The accident occurs shortly after policy inception

-

Prior injury claims are similar in nature

In these situations, insurers may verify patterns to ensure accurate underwriting and compliance. Review does not automatically imply wrongdoing but may reflect routine risk analysis procedures.

7. Potential Fraud Indicators

Insurers use fraud detection systems to identify anomalies. A claim may be escalated if automated systems detect:

-

Inconsistent statements

-

Unusual repair billing patterns

-

Medical billing irregularities

-

Staged accident indicators

Fraud review does not mean a claim is fraudulent; it indicates that certain variables require confirmation. Many claims flagged for fraud screening ultimately proceed once documentation is clarified.

8. Multi-Vehicle or Commercial Involvement

Accidents involving commercial vehicles, rideshare drivers, or multiple carriers often involve layered insurance structures.

Escalation may occur when:

-

Primary and secondary coverage must be coordinated

-

Corporate liability is involved

-

Multiple insurers dispute responsibility

Coordination between carriers may extend the review process.

9. Recorded Statement Discrepancies

If recorded statements contain inconsistencies, further review may be initiated to reconcile differences.

Examples include:

-

Changes in accident description

-

Variations in injury onset timing

-

Conflicting accounts between drivers

Clarification is often sought before liability or damages are finalized.

10. Legal Representation

When an attorney becomes involved, insurers may route the file to specialized adjusters or legal departments. This procedural shift can lengthen review timelines due to:

-

Formal documentation exchanges

-

Settlement demand evaluation

-

Legal compliance review

Attorney involvement does not necessarily trigger suspicion; it often changes the administrative pathway of the claim.

11. Regulatory Compliance Requirements

Insurance carriers must comply with state claim handling regulations. Some claims may require internal documentation to demonstrate:

-

Timely communication

-

Proper investigation

-

Adequate evaluation standards

Complex claims may undergo internal audit checks to ensure regulatory compliance before resolution.

Common Misconceptions About Further Review

Misconception: Further review means automatic denial.

In many cases, further review is procedural and results in continued processing once verification is complete.

Misconception: Further review always indicates suspicion of fraud.

While fraud detection is one trigger, many reviews stem from complexity or documentation gaps.

Misconception: Further review means payment will not occur.

Escalation may simply reflect supervisory approval requirements.

What Typically Happens During Further Review?

During additional review, insurers may:

-

Request supplemental documentation

-

Obtain expert opinions

-

Conduct recorded interviews

-

Review internal underwriting files

-

Consult legal counsel

The timeline for this phase varies depending on complexity, jurisdiction, and documentation availability.

Practical Considerations

While outcomes differ case by case, maintaining organized records and responding promptly to requests may help minimize avoidable delays. Clear, consistent documentation often supports smoother evaluation.

However, some aspects of further review are outside an individual’s control, particularly when coverage interpretation or multi-party coordination is involved.

Read: Why Do Car Accident Insurance Claims Get Delayed?

Conclusion

A car accident claim may be sent for further review for many reasons, including disputed liability, complex injuries, documentation inconsistencies, coverage questions, high claim value, or regulatory compliance requirements. In most cases, escalation reflects procedural caution rather than predetermined denial.

Because claim handling practices vary by insurer, state law, and policy terms, timelines and outcomes differ significantly. Understanding common triggers for additional review can help set realistic expectations during the claims process.

For advice tailored to specific circumstances, consultation with licensed professionals may be appropriate.