This article is provided for general informational and educational purposes only and does not constitute legal advice. Laws, insurance requirements, and fault-determination rules vary by jurisdiction and individual circumstances. Readers should consult a licensed attorney or other qualified professional for guidance specific to their situation.

Introduction

After a car accident, many people expect the insurance process to move quickly. In straightforward property damage cases, resolution may occur within weeks. However, when injuries, disputed liability, or complex documentation are involved, claims can take considerably longer.

Delays in car accident insurance claims are not uncommon. In many cases, the delay is not caused by a single issue but rather by multiple procedural, factual, or administrative factors. Understanding why delays occur can help individuals set realistic expectations and better organize documentation during the review process.

This article explains common reasons car accident insurance claims may be delayed and outlines how the process typically unfolds.

1. Ongoing Medical Treatment

One of the most common causes of delay involves medical treatment that is still in progress.

When an injury claim is filed, insurance companies often wait until medical care stabilizes or reaches a point of “maximum medical improvement” before fully evaluating damages. This is because:

-

Final medical costs may not yet be known

-

Long-term treatment needs may still be uncertain

-

The full extent of the injury may not be documented

If treatment is ongoing, the insurer may pause settlement discussions until sufficient documentation is available.

This type of delay is procedural rather than punitive; insurers generally require complete records to assess the claim accurately.

2. Disputes Over Fault

Insurance companies must determine liability before resolving most claims. When fault is unclear or contested, the investigation may take longer.

Fault disputes may arise when:

-

Drivers provide conflicting statements

-

Witness accounts differ

-

Police reports are inconclusive

-

Physical evidence is limited

-

Multiple vehicles are involved

In some states, comparative negligence rules apply, meaning fault may be shared between drivers. Allocating percentages of responsibility can require additional review.

Until liability is reasonably established, insurers may delay payment decisions.

3. Incomplete or Missing Documentation

Insurance claims rely heavily on documentation. Delays may occur if required materials are missing or incomplete.

Examples include:

-

Missing medical records

-

Unsubmitted repair estimates

-

Lack of wage verification

-

Incomplete accident reports

-

Delayed responses to insurer requests

Insurance adjusters typically cannot finalize evaluations without supporting documentation. If records are requested from third parties, such as medical providers, the timeline may depend on how quickly those entities respond.

Maintaining organized records and responding promptly to requests can help reduce avoidable delays.

4. Coverage Questions

Another source of delay involves insurance policy interpretation.

Coverage disputes may arise regarding:

-

Whether the policy was active at the time of the accident

-

Policy limits

-

Exclusions

-

Uninsured or underinsured motorist provisions

-

Commercial versus personal vehicle use

If coverage is unclear, insurers may conduct additional internal review. In some cases, multiple carriers may be involved, further complicating the process.

Clarifying coverage is a necessary step before payment can be issued.

5. High Claim Volume or Administrative Backlogs

Insurance companies process large volumes of claims, particularly after:

-

Severe weather events

-

Natural disasters

-

Holiday travel periods

-

Regional traffic incidents

During periods of high claim volume, administrative backlogs may occur. Adjusters may manage multiple files simultaneously, which can extend response times.

While administrative delays can be frustrating, they are sometimes the result of workload constraints rather than case-specific concerns.

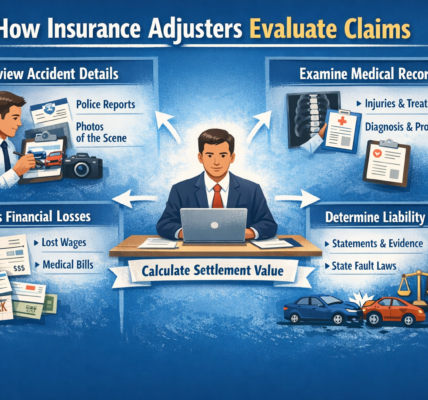

Read: Insurance Adjusters & Claims

6. Requests for Recorded Statements

In some cases, insurers request recorded statements from drivers or passengers. If scheduling conflicts arise or if clarification is needed after an initial interview, review timelines may extend.

Providing accurate, factual information and ensuring availability for communication can reduce scheduling-related delays. However, individuals are generally entitled to understand the purpose of any recorded statement before participating.

7. Independent Medical Examinations

In certain injury claims, insurers may request an independent medical examination (IME). This typically occurs when:

-

Injuries are disputed

-

Treatment appears inconsistent

-

Long-term disability is alleged

Scheduling and conducting an IME can add time to the process. The insurer may wait for the examiner’s report before proceeding with evaluation.

8. Multiple Parties Involved

Accidents involving more than two vehicles often introduce complexity.

Multi-vehicle collisions may require:

-

Coordinated investigations among multiple insurers

-

Comparative fault analysis

-

Shared coverage determinations

When several parties are involved, communication between insurers can extend the timeline.

9. Settlement Negotiations

Once documentation is reviewed and liability is assessed, settlement discussions may begin. Negotiations themselves can take time, especially when:

-

There are disagreements about medical necessity

-

Future treatment is anticipated

-

Fault percentages are disputed

Settlement discussions do not always indicate conflict; they may simply reflect differing interpretations of documentation.

There is no standardized timeframe for settlement resolution. Each claim is influenced by its specific facts and jurisdictional framework.

10. Statutory and Regulatory Requirements

In some states, insurance carriers must comply with statutory claim handling standards. These regulations may include:

-

Timeframes for acknowledging claims

-

Deadlines for responding to communications

-

Requirements for issuing payment after agreement

However, compliance timelines do not necessarily guarantee rapid resolution if investigation is ongoing.

Understanding that regulatory frameworks exist may provide context, but individual claim timelines remain case-specific.

11. Fraud Prevention Measures

Insurance companies implement fraud detection systems to protect against fraudulent claims. While these systems are designed to safeguard policyholders broadly, they may extend review timelines if certain indicators require additional verification.

Fraud screening does not imply wrongdoing by the claimant; it reflects routine internal procedures in some cases.

12. Common Misconceptions About Delays

Several misunderstandings may arise when claims take longer than expected:

Misconception: Delays automatically mean denial.

A delay does not necessarily indicate rejection. It may reflect ongoing documentation review.

Misconception: Larger claims always resolve faster.

More complex or higher-value claims often require more detailed investigation.

Misconception: All claims follow the same timeline.

Each case differs based on injuries, fault, documentation, and policy language.

Read: How Long Does a Car Accident Claim Take to Settle?

Practical Steps That May Reduce Avoidable Delays

While not all delays can be prevented, individuals commonly:

-

Maintain organized copies of records

-

Respond promptly to insurer inquiries

-

Keep documentation consistent and accurate

-

Track communications and deadlines

These steps do not guarantee faster resolution but may reduce procedural slowdowns.

Conclusion

Car accident insurance claim delays can occur for many reasons, including ongoing medical treatment, liability disputes, documentation gaps, coverage questions, and administrative workload. Most delays arise from procedural or evidentiary requirements rather than intentional obstruction.

Because each claim depends on its unique facts, policy terms, and state regulations, timelines vary widely. Understanding common delay factors may help individuals navigate the process with clearer expectations and better preparation.

For guidance tailored to a specific situation, consultation with licensed professionals may be appropriate.